The alternative investment software industry is crowded with companies that claim to deliver full suite, integrated, and easy to use solutions. But, let’s be real, that’s not what most people are feeling.

Many companies that have claimed to democratize, innovate, and automate alternative investment products or operational workflows – have only acquired or repackaged inadequate legacy technology. These solutions uniformly, either lack the operational wherewithal to provide users with ease of use, or dedicate their technical resources on front-end marketing interfaces – that mask the operational Frankenstein within. It’s no surprise that their audience is limited and that they miss the mark with customers.

The result is that many alternative investment softwares are in search of a customer. Things were built because they could be built – not necessarily because the customer wanted or needed it. The hard part is not only to figure out what can be done, but also what customers want or need to do.

For example, at SUBSCRIBE we found that most allocators don’t care for product marketplaces – as a matter of fact, access to compelling opportunities is not a problem at all. And that one of the reasons they use our platform, is that they don’t want some intermediary curating a list of investment opportunities that may not be right for them, or that are delivered by a firm with conflicts of interests.

Rather, they use our open-architecture platform to make their investment process entirely digital – as they curate their own list of institutional investment opportunities. Institutional investors determine their investments themselves – they want to have digitization for their own curated lists. That’s why they use SUBSCRIBE.

SUBSCRIBE tackles a labor-intensive, paper-heavy task of investing in private assets. Up to 80% of firms that allocate between 5% and 40% of their assets to alternative investments, have middle-office professionals spending 50% of their time and energy preparing required paperwork for these investments. There’s so much value-add locked up in the time of these professionals that our platform is able to unlock.

The Wizard of Alts

The creation of new alternative investment offerings is occurring at a rapid pace and for institutional investors it is one of the highest growth segments in financial services. However, many companies that speak of “innovation”, “automation” and the farce of “democratization” to support this growth – have merely repackaged archaic solutions, converted spreadsheets to online tables, and veiled legacy processes behind attractively designed front-end user interfaces. Collectively, these inferior solutions are catalyzing the industry’s “Wizard of Oz” moment. Drawing the curtain reveals cardboard, rusty broken pipes, and burnt wiring. It’s not a surprise that these mechanical turk solutions are coming up short with customers.

Conflicts of Interest

A further corrosive element, and one that inhibits technology innovation, is the invisible-hand of the largest players in the alternatives industry and the main beneficiaries of the status quo. These firms have invested just enough in software to be destructive, and have done so at the expense of fiduciary investors to retain their own market-shares. Their self-interest not only conflicts innovation, it also raises the cost of the investment for investors.

Enterprise Software Solution

Ease of use, or the lack thereof, is a significant hurdle to the growth of the the alternative investments industry. It effects allocators, sponsors, and service providers equally. At Goldman Sachs, where I began my career as an equities sales-trader serving the firms largest hedge fund clients we had a “NYFIX” order entry machine. With the entry of a few data points and the click of a button – any stock was either purchased, sold, or sold-short – in seconds. The lack of a similar mechanism for private assets baffled me for a long time.

Within the alternative investments ecosystem there are three major stakeholders – allocators, sponsors, and service providers. How efficiently these firms interact with each others data, processes, and people determines the ease of use, or lack thereof, everyone will experience. Further, there are three critical moments that define the investment process – pre-trade, at-trade, and post-trade:

- Pre-Trade: the decision making process – activities that relate to product discovery, product distribution, and due diligence.

- At-Trade: the operations workflow – activities that relate to document preparation, execution, submission, and processing.

- Post-Trade: the reporting – activities that relate to investment reporting, maintenance, and communication.

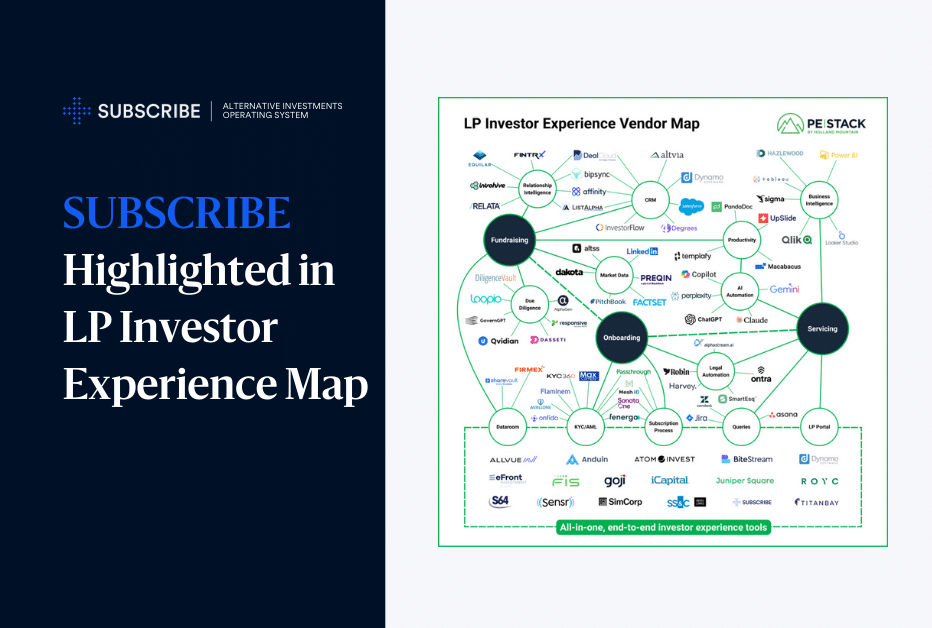

The alternative investments software landscape reveals that few, if any, companies offer a comprehensive technology to tackle this entire continuum of investment processes.

It’s a lot easier to come up with things most people don’t want and a lot harder to develop something that everyone wants and needs. So we did the hard work and developed SUBSCRIBE, the leading electronic subscription document technology for alternative investments. We are Powering Alternative Investments® by delivering the definitive buy button for these private assets. We want people who have chosen great investments to have a great experience.

SUBSCRIBE

ABOUT SUBSCRIBE

SUBSCRIBE is a fintech company digitally transforming the landscape of alternative investments for fund managers, institutional investors, wealth managers, law firms, and fund administrators. Our platform technology modernizes the archaic infrastructure of private fund investments by delivering a central operating system — catering to every role within the investment process empowering them to connect any fund, any investor, anywhere in the world on a single platform.