SUBSCRIBE Launches EXTRACT to Streamline

Reporting Data for Alternative Fund Investors

The new technology offers fund investors that use the platform

a single end-to-end operating system on which to centralize

and manage their alternative investment workflows

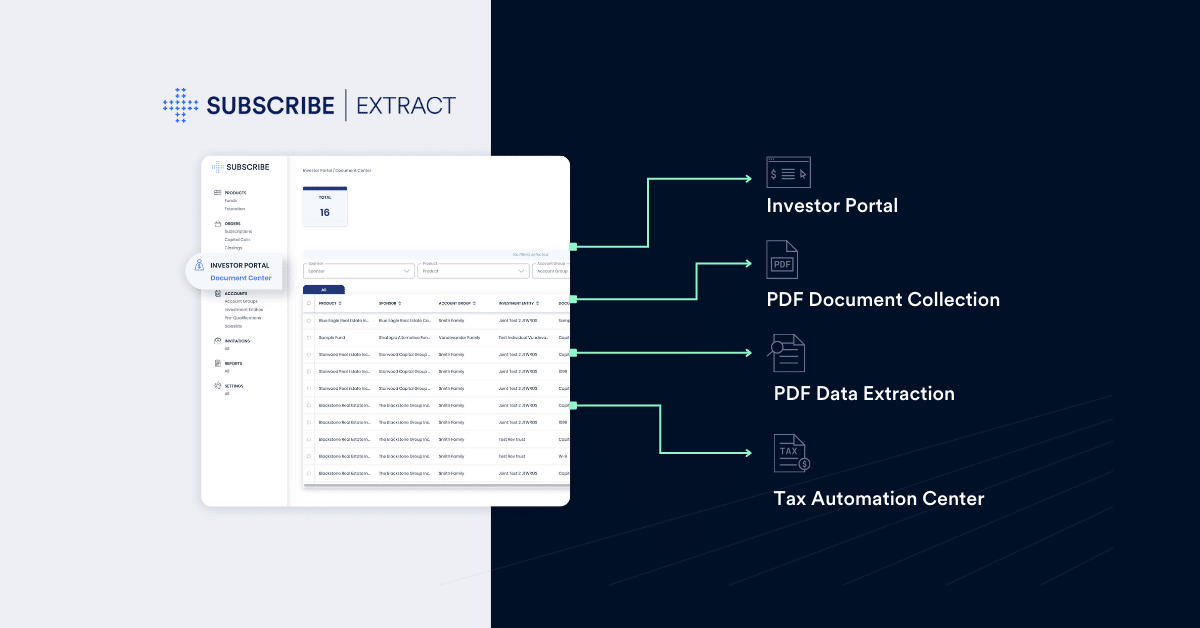

November 13, 2024 (New York, NY) – SUBSCRIBE, a leading operating system for alternative investments serving institutional investors, wealth management firms, fund managers, and service providers, announced today the launch of EXTRACT — a groundbreaking, machine-learning-powered investor portal designed to automate and streamline fund reporting document collection, PDF data extraction, tax information centralization, and the delivery of critical data to downstream systems – thereby empowering institutional investors and wealth managers to collect, organize, extract, and deliver their information using a single end-to-end operating system powered by SUBSCRIBE.

According to Preqin*, global alternative assets under management are expected to surpass $30 trillion by 2030. However, investors aiming to diversify through private funds face significant challenges in managing the volume and complexity of unstructured data, often trapped within PDF, K-1, K-3, and other documents. EXTRACT solves many of the issues facing private fund investors, eliminating the need for investors to log into numerous portals and simplifies sharing information with downstream systems, accountants, and tax advisors—ultimately enhancing data accessibility and operational efficiency.

“With EXTRACT, investors can further centralize their alternative fund investments on SUBSCRIBE. Customers that use us for investor onboarding and electronic subscription transactions now benefit from post-trade automated workflows to eliminate manual, repetitive, and error-prone work related to tracking their fund positions.”

– Rafay Farooqui, Founder and Chief Executive Officer at SUBSCRIBE.

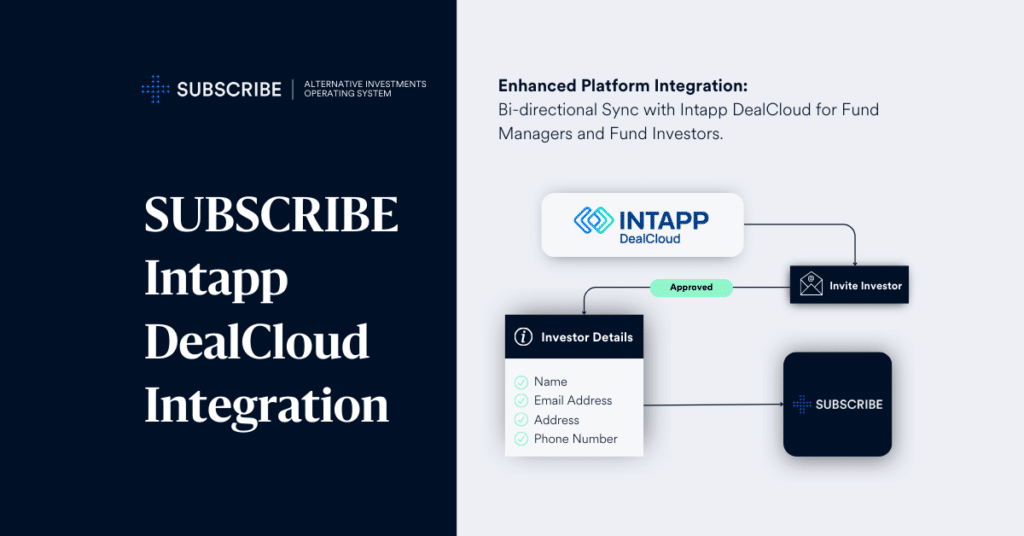

Since 2015, SUBSCRIBE has pursued a bold vision: to modernize the infrastructure and centralize the services support firms that make alternative fund investments. Focused on all workflows and functionality across the pre-trade, trade, post-trade investment lifecycle, SUBSCRIBE’s platform serves thousands of fund managers—including many from the PEI 300—and a diverse client base of institutional investors, investment consultants, wealth managers, family offices, law firms, and fund administrators. As a leader in end-to-end enterprise alts software, SUBSCRIBE offers digital investor onboarding, electronic subscription transactions, AML/KYC, and tax compliance services. With the introduction of EXTRACT, SUBSCRIBE extends its capabilities to streamline and synthesize post-trade reporting data, driving even greater operational efficiency. SUBSCRIBE currently supports over $6 trillion in private market assets, processes billions in private fund subscriptions each year, and manages millions of investor accounts on its platform.

*Preqin Future of Alternatives 2029 report, published in September 2024

ABOUT SUBSCRIBE

SUBSCRIBE is a fintech company digitally transforming the landscape of alternative investments for fund managers, institutional investors, wealth managers, law firms, and fund administrators. Our platform technology modernizes the archaic infrastructure of private fund investments by delivering a central operating system — catering to every role within the investment process empowering them to connect any fund, any investor, anywhere in the world on a single platform.