Product Update:

SUBSCRIBE Launches CoPilot: An AML/KYC

Digital Solution for Fund Managers, Investors,

Law Firms, and Fund Administrators

The update addresses the new anti-money laundering (AML) rules

that come into effect starting on January 1, 2026.

Introducing AML CoPilot by SUBSCRIBE, a digital solution to centralize, manage, and track investor AML/KYC for fund managers, investors, law firms, and fund administrators. Specifically, the AML CoPilot seeks to address the new anti-money laundering (AML) rules that come into effect starting on January 1, 2026.

In 2024, the Securities & Exchange Commission (SEC) & Financial Crimes Enforcement Network (FinCEN) published a final rule that will impose the same standard of AML care on SEC-registered Exempt Reporting Advisors (ERAs) and Registered Investment Advisors (RIAs), as financial institutions like banks and broker-dealers are subject to today. The change means ERAs and RIAs require a robust process around anti-money laundering rules for all limited partners and affiliated entities.

For fund managers and private fund investors, SUBSCRIBE’s technology supports the collection, review, and refresh of AML/KYC data and documentation for fund managers, fund investors, and service providers since inception, and we have now enhanced this capability to meet the new regulations in AML CoPilot.

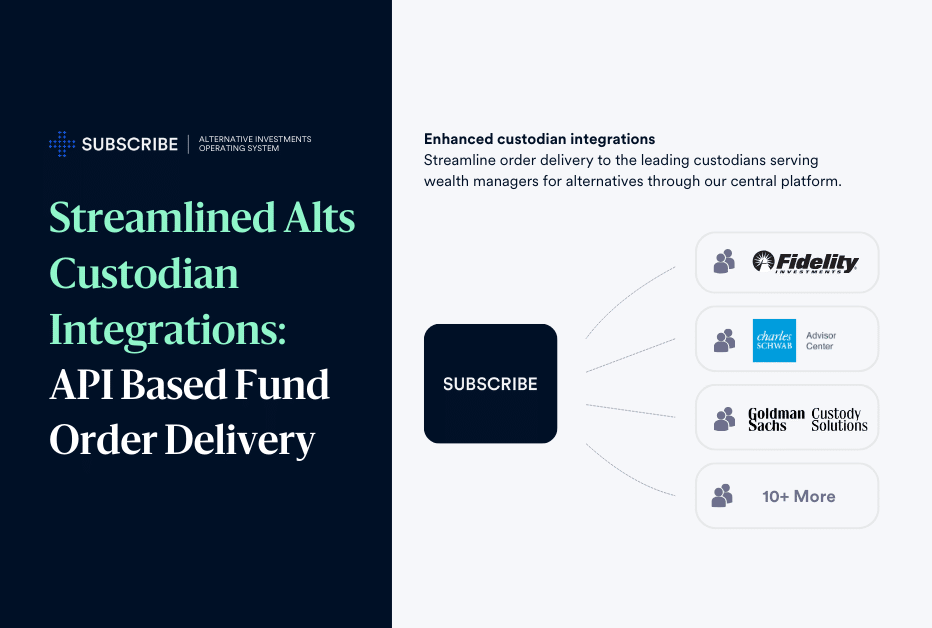

Nearly 1000 organizations use our AML/KYC solutions to collect the appropriate information about each limited partner and ensure none are sanctioned, politically exposed, or otherwise unfit. Our solution seamlessly integrates into law firms, fund administrators, and third-party systems via our open APIs.

SUBSCRIBE AML CoPilot is already collecting and helping to manage limited partner AML/KYC information for over 11 million legal investment entities. Schedule a call to see how SUBSCRIBE can streamline your limited partner AML/KYC process: https://subscribeplatform.com/connect-with-us/

ABOUT SUBSCRIBE

SUBSCRIBE is a fintech company digitally transforming the landscape of alternative investments for fund managers, institutional investors, wealth managers, law firms, and fund administrators. Our platform technology modernizes the archaic infrastructure of private fund investments by delivering a central operating system — catering to every role within the investment process empowering them to connect any fund, any investor, anywhere in the world on a single platform.