Jefferies Private Wealth Management, the wealth management division of Jefferies Financial Group, selected SUBSCRIBE as its new order management system for its custom alternatives investment platform.

"Jefferies’ alternatives platform – a ‘best ideas’ selection of alternatives funds – has exploded in popularity over the past 24 months. Switching to SUBSCRIBE’s automated solution will save us thousands of hours annually, and allow us to serve our clients with speed and efficiency as we continue to grow."Managing Director and Global Head of Investment & Wealth Solutions, Jefferies

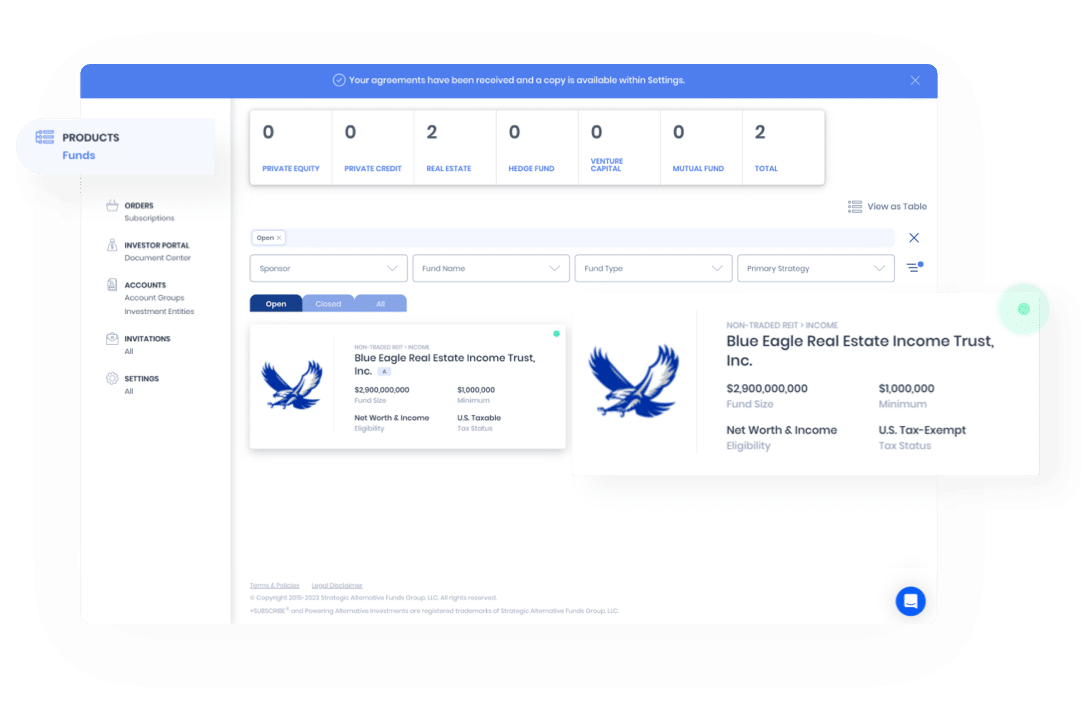

The brainchild of former Goldman Sachs banker and CAIS Co-Founder Rafay Farooqui, SUBSCRIBE is a SAAS-based operational platform designed primarily to streamline the onerous subscription process for the alternatives industry. It has become the private fund industry’s largest order management system for alternative product transactions – providing a state-of-the-art electronic subscription document technology to more than 4,000 institutional investors and private fund managers across the globe.

"Centralizing operations through SUBSCRIBE does more than benefit our fast-growing alternatives team. It provides efficiencies at all levels of our investment team plus product management, compliance, and operations. It’s a win for anyone responsible for part of the alts investment lifecycle."Global Co-Head of Jefferies Private Wealth Management

"It’s an opportunity for transformational change in how we operate our private wealth business overall. One aspect of our strategic initiative to drive innovation through technology. Implementing tech like this will help us stay at the forefront of the investment industry, and help ensure our advisors remain highly agile in providing the sophisticated, custom experience our private and institutional clients trust us to deliver."Global Co-Head of Wealth Management

Alternative investments at Jefferies Private Wealth have grown significantly for the past two years. The firm ascribes their success to their distinct selection of best-in-class managers at both ends of the alternatives market, encompassing both established names as well as unique, niche opportunities in their curated offering. They are looking to the SUBSCRIBE platform to help them continue to grow the alts group without adding significant overhead by centralizing aspects like product training and education, compliance oversight controls, and the subscription process, while remaining fully integrated with third-party custodians, reporting providers, and other software vendors.

“

“We are pleased to be the solution of choice for Jefferies, and other leading institutional investors, to power their curated menu of alternative investment products across private equity, real estate, private credit, and hedge funds. Our platform empowers investment professionals to browse, research, transact, and operate positions through the investment life cycle within a single software solution that supports any direct alternative investment fund or indirect feeder fund offered by retail placement and distribution platforms."Founder and CEO at SUBSCRIBE

The announcement of Jefferies Private Wealth Management, follows news of SUBSCRIBE being adopted by the $22 billion leading Hybrid RIA Sanctuary Wealth and Oppenheimer & Co, Inc. early this year.

About Jefferies

Jefferies (NYSE: JEF) is the largest independent, global, full-service investment banking firm headquartered in the U.S. Focused on serving clients for 60 years, Jefferies is a leader in providing insight, expertise and execution to investors, companies and governments. Our firm provides a full range of investment banking, advisory, sales and trading, research and wealth management services across all products in the Americas, Europe and Asia. Jefferies’ Leucadia Asset Management division is a growing alternative asset management platform.

ABOUT SUBSCRIBE

SUBSCRIBE is a fintech company digitally transforming the landscape of alternative investments for fund managers, institutional investors, wealth managers, law firms, and fund administrators. Our platform technology modernizes the archaic infrastructure of private fund investments by delivering a central operating system — catering to every role within the investment process empowering them to connect any fund, any investor, anywhere in the world on a single platform.