Innovative enterprise software streamlines workflows for advisors across the full life-cycle of alternative investment funds

NEW YORK, Nov. 1, 2022 /PRNewswire/ —SUBSCRIBE, the leading platform for centralizing and managing private market fund transactions, today announced its selection by Oppenheimer & Co. Inc, a leading global private bank and wealth management business, to provide a custom alternative investment platform delivering improved operational efficiencies, and a seamless and transparent experience for wealth advisors and clients investing in a highly curated menu of alternative fund offerings. SUBSCRIBE is the alternative investment industry’s largest order management system for alternative product transactions, providing a state-of-the-art electronic subscription document technology to over 4000 institutional investors and private fund managers, globally.

"By shifting from a multitude of fragmented retail distribution platforms and other digital solutions offered by direct fund managers to a central operating system that inter-operates with all systems, we will not only modernize our technology, but we will also drive our wealth business innovation. Our clients trust us to deliver the best technology and execution possible. In working with SUBSCRIBE, we ensure that our advisors are highly agile, leveraging technology to deliver faster and more customized private asset solutions, and optimizing and automating data to drive better client outcomes.”President, Oppenheimer Asset Management

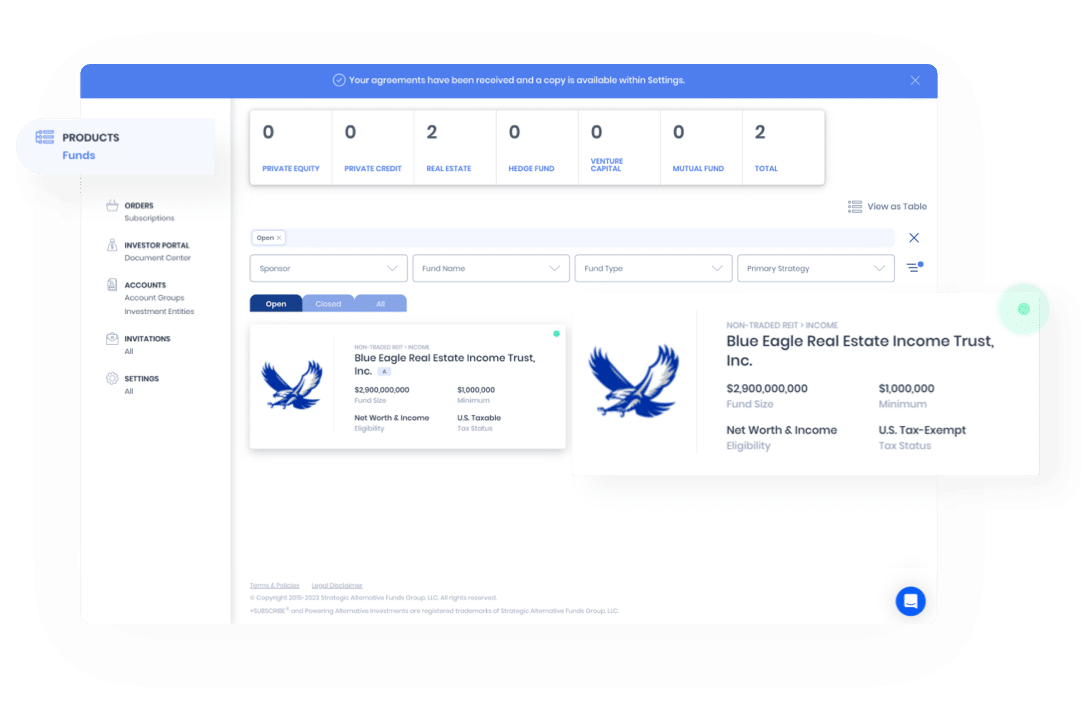

Through the SUBSCRIBE platform, Oppenheimer product management, compliance, operations, and financial professionals all benefit from centralization of a highly curated product menu, product training and education, embedded compliance oversight controls, the simplifying of the investment process, and seamless integrations with third-party custodians, reporting providers, and other software vendors to deliver ease-of-use and scale for financial professionals seeking to solve the needs of their clients.

“The collaboration with SUBSCRIBE represents a transformational change and an opportunity for Oppenheimer to be at the forefront of private asset investing. They are our trusted partner and have demonstrated a successful technology platform roll-out, adapting to the needs of our financial professionals and clients."Managing Director, Head of Research & Due Diligence and Alternative Investments at Oppenheimer

“We are pleased to be the solution of choice for Oppenheimer, and other leading institutional investors, to power their curated menu of alternative investment products across private equity, real estate, and private credit, and hedge funds. Investment professionals are empowered to browse, research, transact, and operate positions through the investment life cycle within a single software solution that supports any direct alternative investment fund or indirect feeder fund offered by retail distribution platforms."Founder and CEO at SUBSCRIBE

The partnership announcement with Oppenheimer & Co, Inc. follows news of SUBSCRIBE being adopted by the $22 billion leading Hybrid RIA Sanctuary Wealth, in June 2022.

About Oppenheimer & Co. Inc.

Oppenheimer & Co. Inc. (Oppenheimer), a principal subsidiary of Oppenheimer Holdings Inc. (OPY on the New York Stock Exchange), and its affiliates provide a full range of wealth management, securities brokerage and investment banking services to high net-worth individuals, families, corporate executives, local governments, businesses and institutions.

ABOUT SUBSCRIBE

SUBSCRIBE is a fintech company digitally transforming the landscape of alternative investments for fund managers, institutional investors, wealth managers, law firms, and fund administrators. Our platform technology modernizes the archaic infrastructure of private fund investments by delivering a central operating system — catering to every role within the investment process empowering them to connect any fund, any investor, anywhere in the world on a single platform.